A SEMINAR ON "TAX LEGISLATION AND TAX SYSTEM IN THE REPUBLIC OF AZERBAIJAN" AT SSU

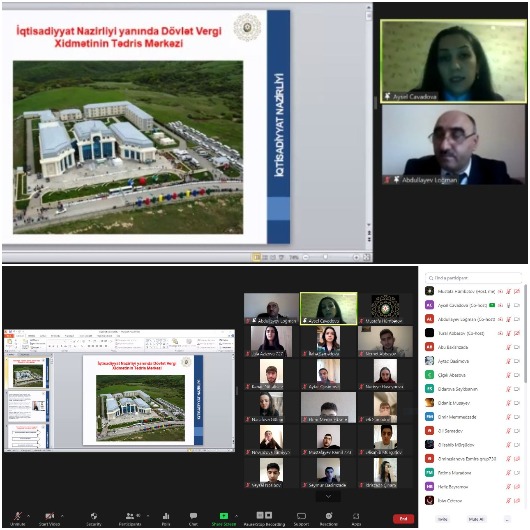

An online seminar on "Tax legislation and tax system in the Republic of Azerbaijan" was organized by the Department of Finance and Accounting of the Faculty of Economics and Management of Sumgayit State University on December 14.

The seminar was opened by the Dean of the Faculty of Economics and Management, Associate Professor Aynura Yahyayeva, who greeted the guests and participants and spoke about the importance of the seminar. She noted that there are close contacts between the Training Center of the Ministry of Taxes of the Republic of Azerbaijan and Sumgayit State University in the field of joint education and research, organization of production and research internships of undergraduate and graduate students in economics, joint events, including excursions, trainings, seminars. She said that holding a seminar on informing students and teachers studying accounting and auditing, finance and other economic specialties of the faculty with new changes will serve to more effectively organize the educational process in the future.

Associate Professor Logman Abdullayev, Head of the Department of Finance and Accounting, spoke about the principles of the tax system, its main functions, the modernization of the tax service, the role of taxes in economic development. He noted that the tax legislation of the Republic of Azerbaijan consists of the Constitution of the Republic of Azerbaijan, the Tax Code and legislative acts of the Republic of Azerbaijan adopted in accordance with them.

The seminar was conducted by Tural Abbasov, a senior lecturer at the Tax Legislation Department of the State Tax Service Training Center. Tural Abbasov said that the purpose of the seminar was to educate participants on the Tax Code of the Republic of Azerbaijan, the tax system and the application of taxes, online clerical work and reporting, to inform participants about the latest changes to the Tax Code. Tural Abbasov also noted that recently there has been a focus on improving tax legislation and administration, and a number of serious steps have been taken further improving the tax environment in the country, expanding the use of electronic services for businesses to easily and easily fulfill their tax obligations, eliminating illegal interference in the activities of businesses.

In the end, the students' questions were answered. Detailed explanations were given on the essence of the amendments to the tax legislation, their practical application, and individual articles of the Code.

Translation: Linguistic Center